当世界主要金属交易所没有金属时会发生什么?

马克•伯顿 | 彭博.com

当伦敦金属交易所的金属用完时会发生什么? That’s the question the exchange is urgently trying to address for its flagship copper contract, which sets the global price for one of the world’s most important commodities.

The problem stems from the LME’s physical nature: anyone holding a contract to expiry becomes the owner of a package of metal in an LME warehouse. On the other hand, anyone who has sold one must deliver the metal when the contract expires.

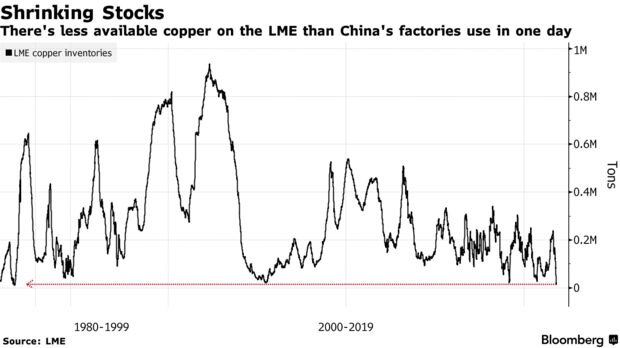

But with available copper inventories at LME warehouses falling below 20,000 tons -- less than China’s factories consume in one day -- traders are grappling with the possibility that there simply won’t be metal available to deliver.

The dramatic drop in stockpiles that began in August and accelerated this month has sent the nearest LME contracts spiking to record premiums over copper for later delivery. That’s particularly painful for copper fabricators -- companies that turn basic metal into things like wires, 板和管, 他们倾向于出售LME期货来对冲自己的价格风险.

But the emptying warehouses have also helped drive benchmark prices toward record levels and copper’s pervasive role in the world means that the jump in costs will add to wide-reaching inflationary pressure for manufacturers and builders. And while mounting threats to global economic activity are raising questions about the outlook for copper demand, 中国和美国的库存.S. LME的竞争对手股价也很低.

Only a small fraction of the world’s copper ever enters an LME warehouse, and copper users tend to have long-term contracts with producers and traders rather than seeking supplies from the exchange. 尽管如此, the fact that exchange stocks are so low -- and not just on the LME -- shows that the market’s buffer has worn dangerously thin.

The LME brought in emergency measures on Tuesday evening to address the situation. Among them was a temporary change in rules allowing anyone with a short position who is unable to deliver copper to defer their delivery obligation for a fee.

“这是前所未有的情况, and we haven’t seen anything like this in the recent history of the copper market,罗宾·巴尔说, an independent consultant who’s been analyzing the LME metals markets for more than 35 years. “这些市场行动是严厉的,但它们是必要的.”

伦敦金属交易所也已展开调查, asking banks and brokers for information on their and their clients’ activity in the copper market over the past two months. Trading house Trafigura Group withdrew a significant proportion of the copper that’s been pulled from LME warehouses in recent months, 彭博社周二报道.

Trafigura responded by saying it had taken LME stocks to deliver to end users, emphasizing there’s strong copper demand that is outstripping available supply. “Trafigura’s role is to ensure security of supply of commodities for its customers,该公司的一位发言人表示.

The LME’s actions are designed to avoid the catastrophic outcome where there simply isn’t the metal available to meet requests for delivery. 通过发起调查, the exchange might make traders and banks think twice before requesting further deliveries.

随着规则的改变, the LME has attempted to defuse the possibility of a squeeze that runs out of control. It is allowing holders of short positions to defer their delivery obligations -- by rolling their position to the next day. It also put a hard cap on how much more expensive copper contracts expiring in one business day can rise over those for a day later.

最后, the exchange has tweaked its rules governing traders who hold a large proportion of available LME stocks. 通常, traders in that position are forced to lend out their position to others in the market at a punitively low rate. 但股市如此低迷, the LME is worried that that rule might deter traders from holding stock on the exchange.

镍飙升

这并不是LME第一次干预其市场. In 2019, the exchange launched a similar inquiry when a rush of orders to withdraw nickel triggered a spike in the nickel price. 市场平静下来,伦敦金属交易所没有采取进一步行动.

In 2006, 在镍价飙升的背景下, it imposed a $300 limit on the daily backwardation in the nickel market. 1992年,当Marc Rich + Co. 试图垄断锌市场, the LME imposed many of the same measures it has done in copper this week: placing hard limits on the backwardation and allowing holders of short positions to defer delivery.

铜价周四回落, and nearby backwardations have eased from recent highs -- perhaps an early indication that the LME’s moves have born some fruit. 关键的现金与三个月期价差跌至295美元.周三75美元一吨, still an extreme backwardation by historical standards but down from a peak of $1,103.周一每吨50美元.

Liquidity in LME contracts tends to be concentrated on the third Wednesday of the month: now traders are hoping for a period of relative calm. 仍然, the LME can’t change the reality that stocks are depleted across the global copper industry, 中国和美国的交易所都有库存.S. 同样处于历史最低水平.

“The LME are in an unenviable position, with stocks being so low,” Bhar said. “希望这将被视为为过热的市场降温的尝试.”